Hey there, friend. Let’s talk about something we all wrestle with at some point—saving money. I know, it sounds straightforward, but in the hustle of daily life, those dollars can slip away faster than you realize. Remember that time I decided to skip my morning coffee run for a week? It started as a small challenge, but by the end, I’d tucked away enough for a nice dinner out. That’s the magic of practical saving money tips—they add up without feeling like a sacrifice.

In this post, we’ll walk through proven simple ways to ramp up your savings, drawing from real-life experiences and solid strategies. Whether you’re just starting out or looking to fine-tune your approach, these tips for saving money can make a real difference in your financial peace of mind.

If you’ve ever felt the pinch of an unexpected bill or wondered where your paycheck vanished, you’re not alone. Many of us face those moments when money feels tight, and it’s easy to get overwhelmed. But here’s the good news: with some thoughtful money saving advice tips, you can turn things around. We’ll cover everything from tracking your spending to smarter shopping habits, all while keeping it relatable and actionable. By the end, you’ll have a toolkit of tips on saving money that fits your lifestyle.

Why Focus on Saving Money Tips Now?

In today’s world, where costs seem to rise every time you blink, building a savings buffer isn’t just smart—it’s essential. Think about it: that emergency fund could cover a car repair, or those extra dollars might fund a family trip you’ve been dreaming about. I once ignored my spending patterns until a surprise medical expense hit, and let me tell you, scrambling to cover it was stressful. That’s when I committed to these saving money tips, and they’ve helped me build a cushion that brings real security.

Starting with the basics, understanding your “why” behind saving sets the foundation. Maybe you’re saving for a home down payment, retirement, or just to sleep better at night knowing you have options. Whatever your reason, these tips for saving money emphasize small, consistent steps over drastic changes. Research shows that people who track their progress are more likely to stick with it, so let’s build habits that last.

One key aspect is mindset. Shift from seeing saving as deprivation to viewing it as empowerment. When I reframed my budget as a way to prioritize what matters—like time with loved ones over impulse buys—it changed everything. Incorporating money saving advice tips into your routine can feel like a conversation with your future self, ensuring you’re set up for success.

Also Read: Lessinvest.com: Top Techniques to Secure Profitable Returns.

Essential Saving Money Tips for Beginners

If you’re new to this, don’t worry—we’ll start simple. These foundational tips on saving money are like the building blocks that anyone can use, no matter your income level.

Track Your Expenses Like a Pro

First up in our list of saving money tips: get a handle on where your money goes. It’s eye-opening. For a month, I jotted down every purchase, from groceries to that late-night snack delivery. What I found? Little leaks, like subscription services I barely used, were draining my account.

Use a free app or even a notebook to log expenses. Categorize them—essentials like rent and food versus wants like dining out. This awareness alone can cut unnecessary spending by 10-20%. Among the best money saving tips, tracking stands out because it reveals patterns you might miss otherwise.

Once you see the data, set limits. For example, if entertainment eats up too much, cap it at a reasonable amount. This isn’t about restriction; it’s about control. Sharing this with a partner or friend can make it fun—turn it into a challenge to see who spots the most savings opportunities.

Create a Budget That Works for You

Budgeting might sound boring, but it’s one of the most effective tips for saving money. I used to wing it, thinking I’d remember my limits, but that led to overspending. Now, I follow the 50/30/20 rule: 50% on needs, 30% on wants, and 20% straight to savings.

Tailor it to your life. If housing takes more than 50%, adjust accordingly. Tools like spreadsheets or apps make this easy. The key? Review and tweak monthly. Life changes, and so should your plan. This money saving advice tip has helped me allocate funds intentionally, leaving room for fun without guilt.

Include a “fun money” category to avoid burnout. When I did this, saving felt sustainable, not punishing. Over time, you’ll notice your savings growing, which motivates you to keep going.

Automate Your Savings

Here’s a game-changer among saving money tips: set it and forget it. Direct a portion of your paycheck to a savings account automatically. I started with 5%, and it was painless—out of sight, out of mind.

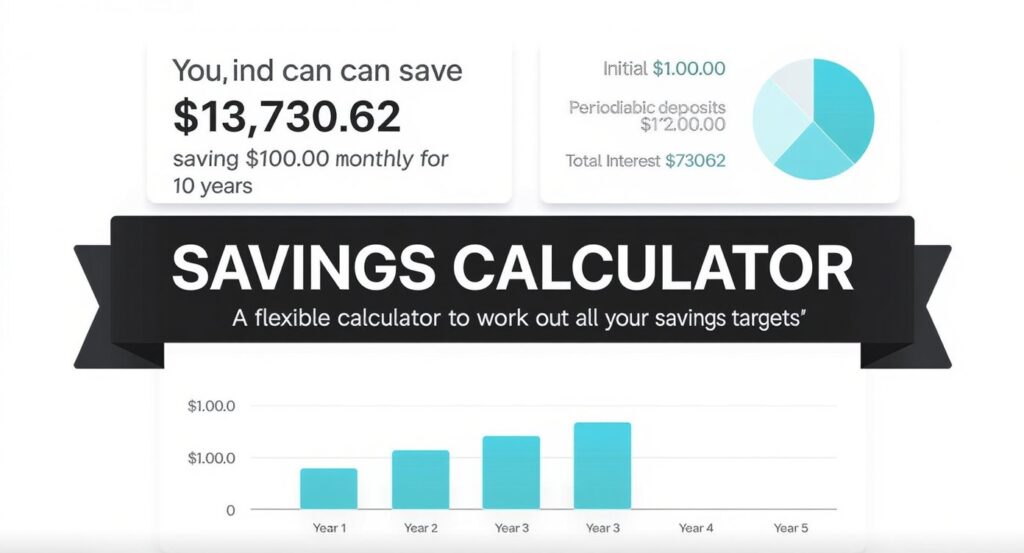

High-yield savings accounts offer better interest rates, so shop around. Even small amounts compound over time. Imagine starting with $50 a month; in a year, that’s $600, plus interest. This tip on saving money builds wealth effortlessly, addressing the common pain of forgetting to save manually.

If bonuses or tax refunds come in, automate transferring a chunk to savings too. It’s like giving your future self a gift.

Also Read: Lessinvest.com Invest: Powerful Tips for Profitable Gains.

Everyday Money Saving Tips to Implement Today

Now, let’s get practical with daily habits. These money saving tips focus on common areas where leaks happen, turning routine choices into savings wins.

Smart Grocery Shopping Strategies

Food costs add up quickly, but with some tips for saving money, you can slash your bill. I learned this the hard way after a month of unchecked shopping left me shocked at the total.

Plan meals weekly and make a list—stick to it. Buy in bulk for staples like rice or pasta if you have storage. Opt for store brands; they’re often just as good and cheaper. Use apps for coupons or cashback. One of my favorite money saving advice tips: shop after eating to avoid impulse buys.

Grow herbs or veggies if possible—it’s rewarding and cuts costs. Batch cooking saves time and money, reducing takeout temptations. Over a year, these tweaks saved me hundreds.

Cut Utility Bills Without Sacrifice

Energy and water bills are sneaky expenses. Simple saving money tips here include switching to LED bulbs and unplugging devices when not in use. I installed a programmable thermostat, and my heating bill dropped noticeably.

Wash clothes in cold water and air-dry whenever possible. Fix leaks promptly—a dripping faucet wastes gallons. These tips on saving money not only pad your wallet but also help the environment, which feels good.

For internet or phone plans, review annually and negotiate. Providers often offer deals to keep customers. Sharing my story: I called my provider, mentioned competitors’ rates, and got a discount without changing service.

Also Read: Lessinvest.com Real Estate: Profitable Market Strategies.

Transportation Savings Hacks

Getting around doesn’t have to drain your funds. Among money saving tips, carpooling or using public transit stands out. I switched to biking for short trips, saving on gas and getting exercise.

Maintain your vehicle—proper tire pressure and regular oil changes improve efficiency. If buying a car, consider fuel-efficient models. For city dwellers, rideshares or walking can replace owning a car entirely.

Track mileage if work-related; deductions add up at tax time. These tips for saving money make commuting less costly and more mindful.

Advanced Tips on Saving Money for Long-Term Gains

Once basics are in place, level up with these strategies. They’re proven to accelerate savings growth.

Invest Wisely to Grow Your Savings

Saving is great, but investing multiplies it. Start with low-risk options like index funds. I dipped my toes in with a robo-advisor, which handles diversification automatically.

Educate yourself—books or online courses demystify it. Remember, time in the market beats timing the market. This money saving advice tip shifts from just saving to building wealth.

Contribute to retirement accounts like 401(k)s, especially if employers match. It’s free money! Aim for at least the match percentage.

Side Hustles to Boost Income

Extra income supercharges savings. Freelance skills you have, like writing or graphic design. I started a small online gig, adding $200 monthly to my savings.

Platforms make it easy—sell handmade items or tutor. Choose something enjoyable to avoid burnout. These tips on saving money by earning more address the income side of the equation.

Set a goal: use side hustle earnings solely for savings. It keeps motivation high.

Debt Management as a Saving Strategy

High-interest debt eats savings potential. Prioritize paying it off. I used the snowball method—tackling smallest debts first for momentum.

Consolidate loans if rates are better. Avoid new debt by using cash for purchases. This among saving money tips frees up money for actual savings.

Build an emergency fund to prevent debt cycles. Three to six months’ expenses is ideal.

Also Read: LessInvest.com Crypto Guide: Insider Profitable Tactics.

Common Pitfalls in Saving Money Tips and How to Avoid Them

Even with the best intentions, mistakes happen. Let’s address them head-on.

Ignoring Small Expenses

Those $5 coffees add up. Track them—awareness is key. I cut back to home-brewed and saved $100 monthly.

Lifestyle Inflation

As income rises, so can spending. Combat this by increasing savings percentage with raises. When I got a promotion, I allocated half the increase to savings.

Not Reviewing Progress

Set monthly check-ins. Adjust as needed. This keeps tips for saving money effective.

Emotional spending is another trap. When stressed, I used to shop. Now, I pause and ask if it’s necessary. Journaling helps process feelings without spending.

Building a Support System for Your Saving Journey

Saving doesn’t have to be solo. Join online communities or accountability groups. Sharing wins and challenges keeps you inspired.

Talk with family about goals—aligning budgets strengthens relationships. My partner and I set joint targets, making it a team effort.

Celebrate milestones. When I hit $1,000 saved, we had a low-cost picnic. It reinforces positive habits.

Wrapping Up These Saving Money Tips

There you have it—a roadmap of saving money tips to boost your savings steadily. From tracking expenses to investing smartly, these proven ways address real-life challenges with practical solutions. Remember my coffee challenge? It’s proof that small steps lead to big results.

Start with one or two tips on saving money that resonate most. Track your progress, and adjust as you go. You’re building not just savings, but financial freedom. What’s your first step? I’d love to hear in the comments—let’s keep the conversation going.

For more useful articles, visit my website: Lessinvest.com.